Three days ago, Nigerian oil mogul and MD of Capital Oil and Gas, Ifeanyi Ubah, boasted that he could make the Nigerian currency bounce back to 200 Naira to the Dollar in the parallel market in 30 days. He also threatened to release the identities of those behind the current foreign exchange problems, claiming the problem was deliberately instituted by some Nigerians. He then appealed to President Buhari to make him his consultant on “financial stability”, without pay, and that he would give the president “the secret” to making the Naira rise to 200 against the Dollar.

Ubah magic

At the time when Ifeanyi Ubah made those statements on national tv, the value of Nigeria’s currency was N390 to the Dollar in the parallel market. By Tuesday evening, it had dropped to N310, prompting the billionaire to go on the social media platform, Twitter, to make certain assertions. “As at this evening, the Dollar has dropped further to N310 against N390 on Sunday evening before my interview on Channels TV,” he said. “This shows that the earlier increase has been artificial as some people were manipulating and benefiting from it.” Though the validity of his claim is not certain, this is not the first time Ubah has seemingly acted as a patriot for his country. Last year, during the most debilitating fuel scarcity crisis, he offered to supply fuel to many petrol stations when other suppliers refused to. Many Nigerians still believe he was responsible for the end of fuel scarcity last year and that notion appears to drive their belief that he did something to influence the rising Naira. For someone who spearheaded some of former President Jonathan’s re-election efforts and also, allegedly, cried after Jonathan lost, it appears he still wants to matter in Nigerian politics and is therefore trying to tread on the good side of President Buhari. However, the bigger issue is that Nigerians seem to believe that only one man, Ifeanyi Ubah, is responsible for the Naira rising against the Dollar.

The Facts

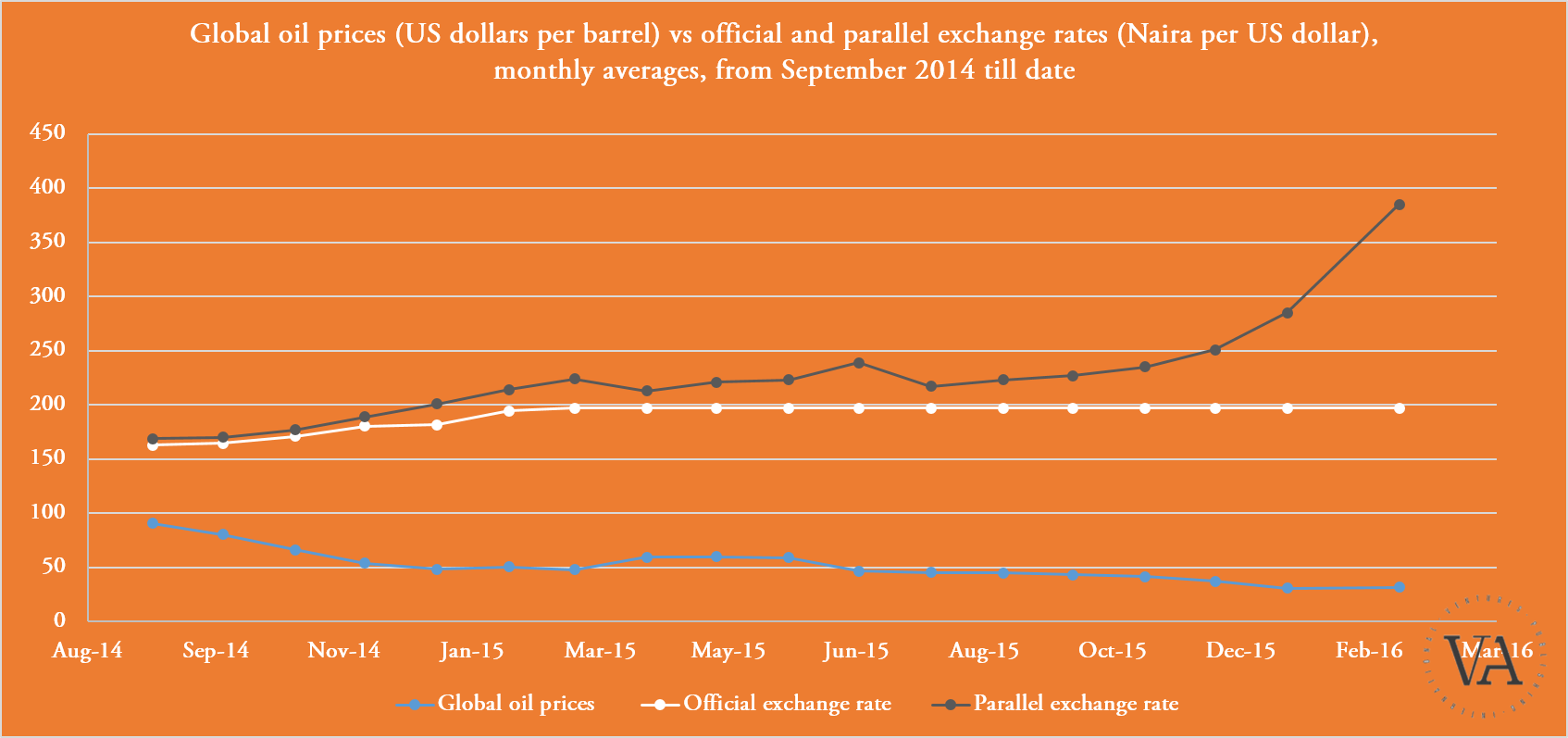

The Nigerian economy is an oil-based one and any fluctuation of the global oil price is bound to affect foreign exchange. So when oil prices fell to a record low of $27.67 this year January, the Naira took a big hit in the parallel market. It appears there is a direct link between the Naira’s strength in the parallel market and the global price of oil, as seen in the graph below.

Since Saudi Arabia and Russia agreed to freeze oil outputs last week to allow lesser influential OPEC members like Nigeria flood the market with its oil, the price of oil has been rising gradually. Coupled with the fact that the United States has cut its forecast for its production of Shale, whose worth is at loggerheads with crude oil, there are many conjectures as to why the value of the Naira could have risen.

On Monday, the rise of the Naira also coincided with President Buhari’s reiteration of his stance that he is not likely to devalue the Naira, seemingly strengthening his belief that the Naira would bounce back. This could have reduced the pressure on the demand for Dollars at the black market, with more people accepting their fate. On his visit to Saudi, one of the main issues discussed during President Buhari’s meeting with Saudi’s King Salman bin Abdulaziz Al Saud, was their commitment to a “stable oil market” and a “rebound of oil prices”. These are just some of the different forces that could have come into play to make the Naira rise in the black market and these forces are easier to believe than the statements of one man.

However, what is the obsession of Nigerians with black market dollars?