Elephant cement maker, Lafarge Africa Plc, has revealed plans to construct studio apartments better suited to the budget of low income earners in Nigeria. The studio apartments will be built on 25 square metres of land comprising one bedroom, kitchen and bathroom and will be sold for N1.5 million ($7,538). Lafarge Africa’s Head, Affordable Housing & Buildings, Jumoke Adegunle, said the company is promoting mass housing technology as a result of the deficiency in housing provision in Nigeria.

Lafarge has already begun constructing 500 housing units in the Gwagwalada area of the Federal Capital Territory, Abuja, to cater to the needs of low income earners in the area. The prototype apartment which takes about 12 days to build is said to not include the cost of land, which is about N4 to N6 million, as Lafarge focuses only in making sure that low income earners have access to affordable real estate.

According to Vanguard Nigeria the materials used in the construction process of the technology is inbuilt. Although Lafarge did not give construction figures for the mass housing project, in a similar move, Eastern African based private equity firm, Phatisa constructed 1,400 studio apartment units for students and young professionals in Nairobi, Kenya for a reported Sh3.8 billion ($41.95m).

Despite Lafarge’s determination to make real estate affordable for Nigerian low income earners, the odds may be against the company due to the fact that the average low income earner may find it difficult to purchase the properties in mention.

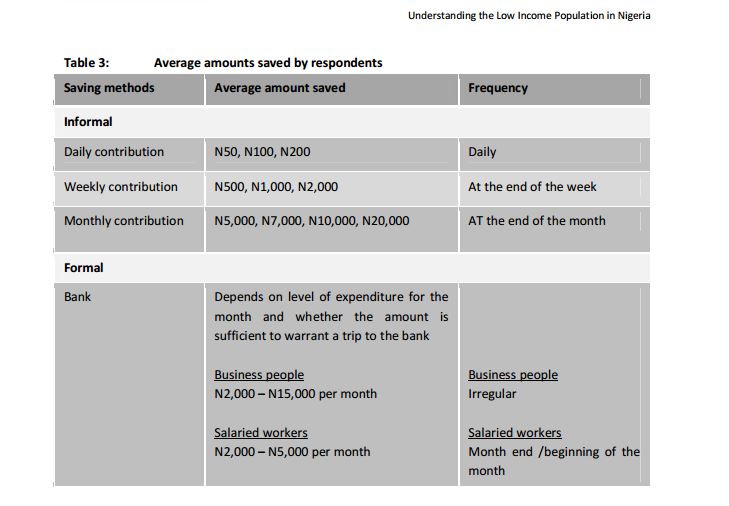

Enhancing Financial Innovation & Access (EFINA) carried out a study in 2011 and according to them, Nigerian low income earners salaries range from N5,000 to N40,000 and these workers were either low grade civil servants or artisans, who may turn to friends or relatives for urgent financial needs. EFINA carried out a qualitative study on how much low income earners save at the end of the month and it was revealed that even when they save, respondents felt their earnings were too low to make any significant purchases.

In 2013, Funmilayo Amao and Adetokunbo Ilesanmi wrote that the housing situation in Nigeria put existing housing stock at 23 per 1000 inhabitants. They also noted that N12 trillion will be required to finance the current deficit. In addition, they outlined house prices and rent as the causes of general inflation composition of houses for sale and rent, while properties on the market become more expensive.

However, Lafarge’s building technology may just be what the country needs at this time, as urban cities are experiencing population growth. For instance in 2010, Lagos state had a population of 17.5 million, while in 2014, it increased to 21 million. Ibimulua Festus and Ibitoye Amos, together, in a policy study conducted in 2015, said Nigerians will move en masse to urban centres even till 2020. They quoted a study which claimed that given an annual population increment of 2.8 percent and all other factors being equal, more than 62 percent will be living in urban centres in Nigeria by year 2020.