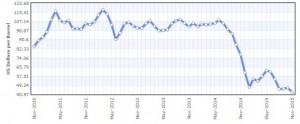

The persistent fall in oil prices has affected various economies of the world, especially countries largely dependent on oil. Last week, oil prices fell below $37 a barrel for the first time since the great recession in February 2009. This crash in oil prices came after the meeting of OPEC exporter’s cartel failed to reach a consensus on a long-term output strategy to help boost the price of oil.

Ventures Africa spoke to the Deputy CEO of the Lagos Deep Offshore Logistics Base (LADOL), Dr. Amy Jadesimi on the impact of falling oil prices and how the Nigerian economy can be sustained.

Ventures Africa: The crash in oil prices has been persistent since the global recession in 2009, what reasons are responsible for this?

Dr. Amy Jadeisimi: The oversupply of crude by some countries is part of the reasons for this persistent crash in oil price. At the OPEC summit this month, Saudi Arabia made it clear they would not reduce the barrels per day they would be producing and therefore, the current state of oversupply in the market will continue hence, the drop in price. Also, the general slowdown in the global economy has come at a time when there is an oversupply of oil and gas creating a situation where the price of oil naturally will drop.

VA: Do you think the President can sustain the economy amidst the fall in oil prices?

AJ: Absolutely, the economy can be sustained because Nigeria is not a poor country. We are rich in human capital, natural resources and I believe the president has the full support of the mandate of the Nigerian people in order to make the structural changes needed in to manage our natural resources that will enable us to feel the benefit at every level of the country.

VA: Is this the right time for the government to remove fuel subsidy?

AJ: I think there are two sides to that. First, since the price of oil is low, then subsidy should be low. I agree with some of the comments made by the World Bank but not all in that I think, we as a people have to make sure that we are seeing the benefit from our natural resources and although in the scheme of things, the impression is that subsidy is of no benefit, we only need to make sure, subsidy goes where it is supposed to go. If the subsidy goes where it needs to go, then I don’t have a problem. But if the people who are supposed to benefit from the subsidy are not benefitting then, we need to find some other ways of making sure that Nigerians benefit from our oil and gas resources.

VA: Which countries benefit under these conditions?

AJ: In theory, Nigeria should be benefitting because we are importing a lot of our products while on the one hand we are losing out on earning foreign currencies. However, the real benefit of the decrease in oil prices should be felt by countries that already have huge manufacturing base, not those who are reliant on manufacturing their fuel like China. A country like china will benefit from fall in oil price more than Nigeria because they have huge manufacturing base. This is a warning sign for Nigeria to increase its manufacturing base so that the next time there is a fall in oil price, we would be able to weather the storm better because we have been able to increase our manufacturing base and we have diversified our foreign income away from our reliance on importing oil and gas.

VA: Do you think the oil prices can return to $100 per barrel?

AJ: I think the oil price may go back high to maybe $50 dollars to 60 dollars and that may be the correct price and we have to look at the time when the whole price will be up to $50 or $60 per barrel. If we can run our economy base when the oil price remains the way it is, when the oil price returns to a high price, we would benefit more from that winkle because we would have put in place manufacturing capacity, diversify the economy so that we can save up in the good times and spread the benefit across the economy.

VA: How has the crash in oil prices affected Nigeria and other countries?

AJ: A country that is heavily reliant on oil for it foreign currency and not very diversified like Nigeria, the crash in oil price has affected our local currency. On the other hand, the crash in price of oil has been beneficial to countries like United States and China whose economy is not dependent on import and the cost of running their economy is cheaper. In other words, the more developed a country is, the less reliant the country is on simple selling commodities, the better off the country is when the commodity price drops.

VA: The crash in oil price happened days after OPEC’s meeting, can it be safely said that OPEC has lost its relevance?

AJ: The OPEC situation is highly complicated and I think the more collaboration, the more the better. It is good idea for a country to be a part of larger organizations and make sure our voice and interest is heard in that body. In the event that becomes clearer to the people that are running it, it is a much more complicated issue than it is being portrayed in the media and I don’t think we should make any short term or quick decision on OPEC.

VA: When is the oil price likely to recover?

AJ: The specific time the price of oil will go up or down is not as important as having a sustainable business that can weather those variations. It is very likely the price of oil will continue to drop but we have to put in place strategies that are independent in the variation in the oil price. So whether the oil price is high or low, we need to fabricate, we need to manufacture, we need to do engineering. Irrespective of the oil prices, we need to put strategies in place we need. Moreover, in a global oil environment, a larger content will be for the market to diversity and create opportunities for companies. We should think in terms of how we can restructure our economy, grow our local businesses so that the fall in oil price is not important to us.

VA: In what ways can the government align our resources in the 2016 budget following this crash in oil prices?

AJ: The Nigerian government should encourage private investors through capacity development to make long term investment. The government should also set up initiative that will support indigenous investment which will drive the economy, encourage local production and increase our industry base. The government also needs to re-strategize on how best to manage the economy which include diversification away from our reliance on oil and gas, increasing our domestic manufacturing and decreasing our lines of import as well as improving the efficiency and the transparency in which our oil and gas industry puts itself.

For more insight, click to listen to the podcast below