Following a dip in the flow of investments into Zimbabwe, there has been a price hike alongside companies selling their goods in dollars. However, the Central Bank has intervened to avoid companies like Anheuser-Busch InBev’s associate in Zimbabwe, Delta Corporation, selling its products in dollars.

In order to regulate the use of foreign currency, the government allocates it to companies to purchase raw materials, especially since the government believes that the bond note quasi-currency in circulation has the same value as the dollar. As a result of this Zimbabweans have been unable to buy, sell or exchange currencies at current or determined prices.

“Other companies would have followed Delta and the danger is that civil servants do not have access to forex,” said Moses Moyo, an economist from Zimbabwe. “That’s why the government had to intervene, but this is just a short-term reprieve as all companies are struggling for forex.”

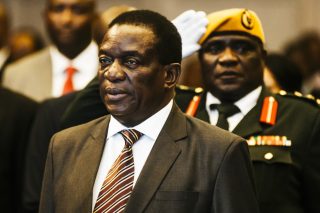

President Emmerson Dambudzo Mnangagwa has been faulted with elaborate spending on ministers while increasing taxes levied on the citizens of Zimbabwe at the detriment of the citizens. This crisis is amidst a recent strike by doctors and teachers in the African country. Experts and lawmakers in the opposing party of the ruling government have also said that the speculations for the country to grow economically by about 3.1 percent this year is no longer visible.

The former minister for finance, Tendai Biti who is in alliance with the opposing party has said that this administration has failed to turn around the economy of Zimbabwe and so a meeting between the two biggest political leaders in the country has been scheduled in order to find a headway for the African country.

If no investment or inflow of foreign currency is made in Zimbabwe, it would dampen the economy rather than grow it. Many companies would have no choice but to start selling at higher prices or in dollars which many people would be unable to afford.